In the ever-evolving landscape of industrial automation, companies are constantly seeking new ways to enhance their offerings and cement their reputation as leaders in innovation and reliability. Recently, Emerson Electric Co. has propelled itself into the spotlight with two significant moves: a strategic push toward advanced cybersecurity solutions for industrial automation and a notable dividend increase for shareholders. Both developments could potentially reshape Emerson’s narrative in its sector, positioning the company as both financially robust and technologically forward-looking. If you’re curious about the long-term impacts of these decisions, this in-depth exploration will unpack just how these initiatives could influence Emerson’s standing and the industrial automation market at large.

Table of Contents

- Introduction

- Emerson’s Cybersecurity Push: Proactive Strategies in a Digital Era

- The Current Cyber Risk Landscape in Industrial Automation

- Dividend Hike Implications: Signaling Strength to Investors

- Shareholder Strategy and Long-Term Thinking

- Impact on Industrial Automation: Shifting Priorities, Lasting Benefits

- Market Reactions and Expert Insights

- Summary: Emerson’s Next Chapter

- FAQs

- Sources

Introduction

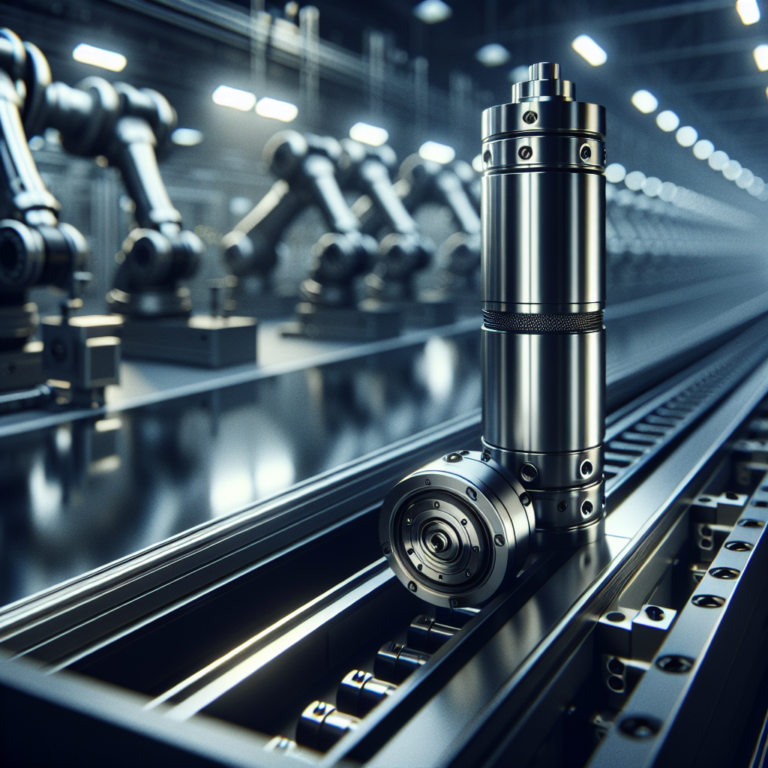

The concept of industrial automation once brought to mind images of robotic arms, conveyor belts, and highly specialized production lines. Today, the reality extends far beyond mechanical reliability. Connectivity, data-driven decision-making, and above all, cybersecurity, have become the new pillars of success for every player in the field. As connectivity grows, so do the risks. Emerson Electric Co.’s recent initiatives—a major investment in cybersecurity and a notable boost in shareholder dividends—mark a pivotal moment for the company. Not only do these moves address both technological and financial concerns, but together, they articulate a broader, bolder strategy that aims to redefine Emerson’s industrial automation narrative.

Emerson’s Cybersecurity Push: Proactive Strategies in a Digital Era

Industrial organizations have never faced a more complex or fast-evolving cyber threat landscape. According to Automation.com, more than half of industrial firms have reported at least one cyber incident in the past year. And with each new advancement—more sensors, smarter automation, greater system integration—new vulnerabilities inevitably appear.

Emerson has chosen to tackle this reality head-on. The company has markedly increased its investments in both cybersecurity research and in embedding robust cybersecurity measures directly into its automation solutions. Rather than viewing security as something to be bolted on after the fact, Emerson is integrating it from the ground up. This proactive approach means greater peace of mind for Emerson’s customers—who are increasingly aware that a single cyber incident can not only interrupt operations but potentially devastate an entire business.

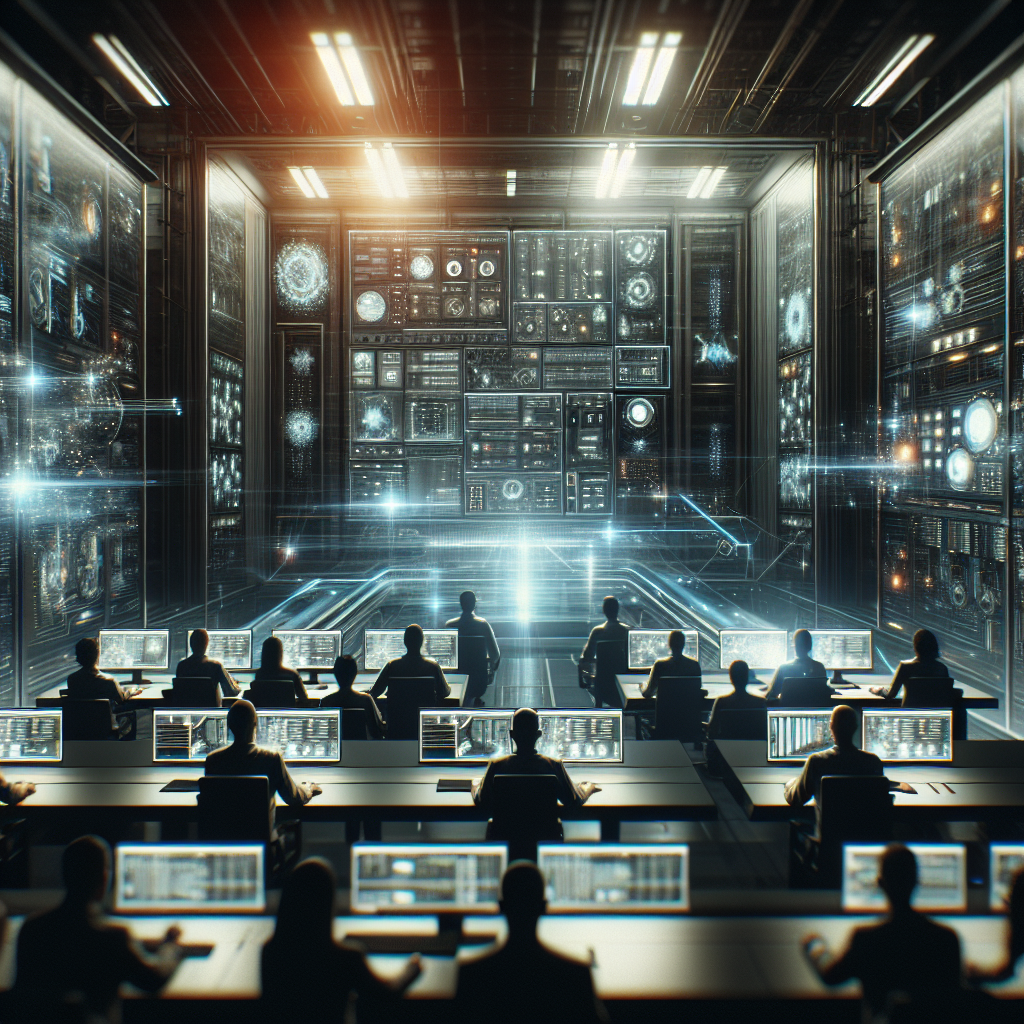

Besides technological advancements, Emerson has also strengthened its client-facing services, including offering comprehensive cybersecurity assessments, incident response planning, system hardening, and employee training modules. These services aren’t just about technology; they are about building a culture of security across the organization. It’s a recognition that real-world cybersecurity is as much about people and processes as it is about code and firewalls.

For industrial customers who depend on reliable and continuous processes—be those in manufacturing, oil and gas, food and beverage, or utilities—this focus is critical. A cyberattack that disables automation in a food processing plant or a power station is not only costly but may pose risks to public health and safety.

As digital transformation continues, Emerson’s comprehensive, disciplined approach to cybersecurity is likely to serve as a benchmark in the sector. By anticipating threats and equipping customers to defend against them, Emerson is building reputational equity that may, in the coming years, prove even more valuable than its current suite of automation products.

The Current Cyber Risk Landscape in Industrial Automation

To appreciate the full significance of Emerson’s cybersecurity investments, it’s worth situating them within the broader industry context. High-profile ransomware attacks on industrial targets—from municipal utilities to food processing conglomerates—make headline news with alarming frequency. But the less visible, more insidious consequences of an insecure industrial system—such as data tampering, intellectual property theft, and industrial espionage—can do just as much damage, if not more.

Industrial control systems (ICS) and operational technology (OT) networks are integral to automation but were not designed with internet-scale threats in mind. Many legacy systems operate with outdated protocols and minimal protection. The result? A target-rich environment that’s far too appealing for cybercriminals and even state-sponsored actors.

Emerson’s efforts to offer hardened, by-design protection are thus not only timely but necessary. By building secure architectures, emphasizing segmentation of critical networks, and advocating for regular security patching and monitoring, Emerson is helping to evolve the industry standard for what a responsible automation partner looks like.

Moreover, as regulatory attention increasingly focuses on the cyber-resilience of critical infrastructure, Emerson’s cybersecurity leadership may help its customers stay ahead of emerging legal requirements. Being proactive is not merely a selling point—it’s a practical approach to business continuity and risk management in a world where threats grow more sophisticated by the day.

Dividend Hike Implications: Signaling Strength to Investors

While technology is transforming industries in real time, investor confidence remains rooted in classic indicators of corporate health—among them, steady and growing dividend payments. Emerson’s recently announced dividend hike is more than just a nice bonus for shareholders. According to Reuters, this move stands in stark contrast to the caution being exercised by many firms in the current economic climate, where uncertainty and volatility have often led to pauses or even reductions in dividend payments.

By increasing its dividend payout, Emerson is sending several messages to the market. First, it suggests that the company’s leadership has confidence in the business’s current performance and, crucially, in its future cash flow. Second, it promises stability and consistent returns to its investor base, which is particularly attractive to institutional and individual investors looking for reliable income streams amid market turbulence.

This signal of strength can boost share price performance and potentially make the company’s stock more attractive to income-oriented investors and large funds that prioritize companies with a strong track record of returning capital to shareholders. In a sector marked by both cyclical swings and rapid innovation, this financial discipline can set Emerson apart.

Shareholder Strategy and Long-Term Thinking

A dividend hike is a commitment not just to current shareholders, but to the ethos of long-term value creation. Emerson’s gesture reflects a broader, more deliberate shareholder engagement strategy. It conveys a message: while the company is investing heavily in technology, research, and operational capability (such as its cybersecurity drive), it is equally committed to delivering measurable, ongoing value to those who invest in its vision.

This dual focus is particularly important at a time when investors are searching for a smart balance between innovation and capital discipline. Growth, after all, must be sustainable—it should not come at the cost of over-leveraging the company or ignoring the needs of those who have tied their savings and retirement planning to the company’s fortunes.

In fact, studies have shown that companies with a record of increasing dividends tend to outperform over the long run, not only because they cultivate investor loyalty but because regular dividend payments often force management to practice prudent capital allocation. By making a visible, public commitment to both, Emerson reinforces its standing as a market stalwart—resilient in challenging times and ready to seize new opportunities when they arise.

Impact on Industrial Automation: Shifting Priorities, Lasting Benefits

The interplay of Emerson’s cybersecurity initiative and its dividend strategy creates a unique confluence that could reverberate well beyond its own walls. Forward-thinking customers and analysts are likely to see this as evidence of a company prepared to meet today’s challenges—whether technical, regulatory, or financial—head on.

Cybersecurity is no longer a back-office IT concern. In modern industrial automation, it’s a board-level issue and a fundamental pillar of every large-scale digital transformation project. According to MarketScale, the very heart of industrial automation is connectivity. Real-time data delivery, remote monitoring, predictive maintenance—they all stem from a foundation in networked systems. As these technologies move from the pilot stage to full enterprise deployment, the risk profile expands exponentially.

Market observers will thus recognize that Emerson’s narrative is shifting: from being just another provider of automation technology to becoming a trusted partner in risk mitigation, business continuity, and industrial resilience. By combining solid financial practices (dividend growth) with technological leadership (cybersecurity innovation), Emerson is re-casting itself as an essential ally for businesses seeking transformation, not just incremental improvement.

There are additional benefits as well. Customers who choose Emerson gain a partner capable of guiding them through not only the practicalities of deploying industrial automation systems but the complexities of keeping those systems safe, compliant, and robust against evolving threats. This trust could lead to deeper, stickier customer relationships and multi-year contracts, further strengthening Emerson’s competitive position.

Market Reactions and Expert Insights

The convergence of technological and financial strategy tends to draw notice from both market analysts and industry insiders. Early signals based on financial news coverage indicated that Emerson’s dividend hike was met positively by investors, with markets interpreting the move as a sign of stability and forward momentum. Meanwhile, cybersecurity analysts highlighted the company’s decision to advance not just product innovation, but holistic system security, as a needed evolution for the entire sector.

Key industry experts have remarked that Emerson’s substantial push into cybersecurity places it at the vanguard of a crucial shift in industrial automation. As digital transformation initiatives define the next decade of industrial growth, few areas will be as pivotal—or as scrutinized—as cybersecurity. The companies that invest smartly now, integrating safeguards and resilience into every facet of their offering, are those most likely to win the next wave of contracts, especially in tightly regulated and mission-critical industries.

Finally, some analysts have pointed to Emerson’s strategy as a blueprint for others to follow: invest in what matters most to customers (security, uptime, continuity) while ensuring long-term rewards for shareholders. The success of this approach, if sustained, could influence the industrial automation landscape for years to come.

Summary: Emerson’s Next Chapter

In sum, Emerson’s fortified commitment to cybersecurity and its renewed promise of shareholder returns are more than just timely decisions. They reflect a calculated, comprehensive approach to industrial automation’s toughest challenges. Emerson’s strategy positions it as a leader not only in technology and innovation but in building trust and delivering value. As cyber risks rise and investor expectations grow in complexity, Emerson’s moves may indeed reshape not just its own narrative, but potentially set new standards for the entire industrial sector.

FAQs

- What is Emerson’s recent cybersecurity initiative? Emerson is investing significantly in new cybersecurity technologies and services for industrial automation, providing clients with advanced defenses against emerging threats. This includes integrated system security, ongoing threat monitoring, and employee training.

- How does the dividend hike affect investors? The increased dividend demonstrates Emerson’s solid financial footing and commitment to returning value to shareholders, making it an appealing choice for income-seeking investors and reinforcing long-term confidence.

- Why is cybersecurity important in industrial automation? As industrial systems become more interconnected, they also become more vulnerable to cyberattacks. Robust cybersecurity is essential not only for data protection but also for uninterrupted operations, worker safety, and regulatory compliance.

- How does Emerson’s approach compare to industry trends? Emerson’s focus is closely aligned with the industry’s major shifts: connectivity, digital transformation, and the prioritization of cyber resilience. By integrating cybersecurity into every layer, Emerson differentiates itself from peers relying on add-on security measures.

- Will these changes benefit Emerson’s customers? Emerson’s comprehensive security strategy provides not just technical protection, but also advisory services and compliance support, strengthening customer relationships and helping clients manage risk as they modernize operations.

- Are these moves unique to Emerson? While other automation providers are also investing in cybersecurity, Emerson’s combination of technical leadership and financial commitments (e.g., dividend increases) is a distinctive, holistic approach in the industry.