The industrial automation cable market stands at the crossroads of profound technological change and global industrial evolution. As factories around the world modernize operations and expand their automation profiles, the demand for reliable, robust, and high-performance cables has surged. But understanding this market requires a close look at its granularity—how segments differ, what shapes its dynamics, and where the competitive frontier truly lies. In this article, I’ll walk you through these fundamentals, add new layers of insight, and help decode both the current state and the future potential of the industrial automation cable market. For reference, see the latest overviews at openPR.com.

Table of Contents

- Introduction

- Market Segmentation

- Market Dynamics

- Emerging Applications and Technology Trends

- Regional Insights

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

- Summary

- FAQs

- Sources

Introduction

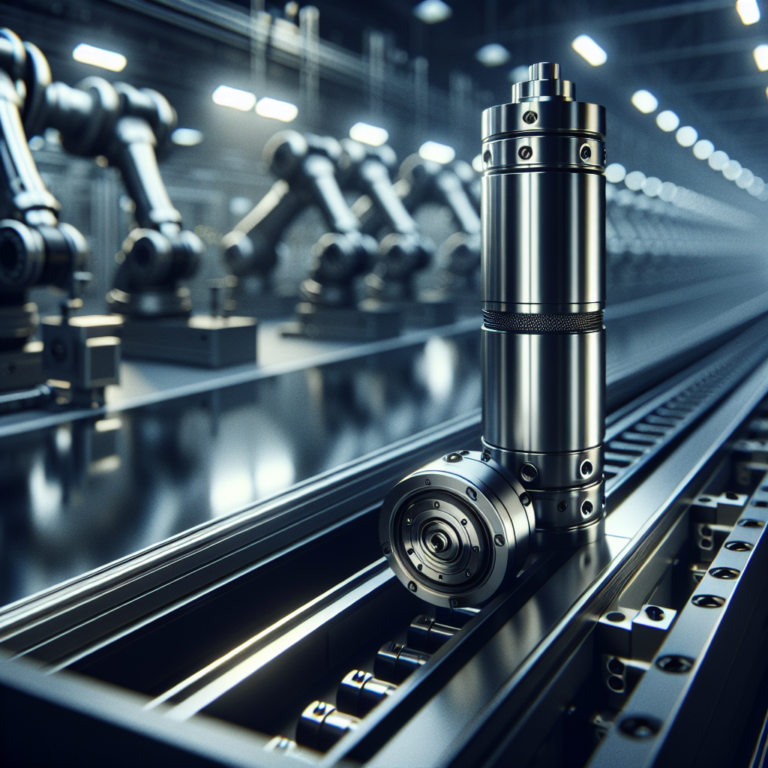

The industrial automation cable market is more than just a sector for wiring—it is a foundational pillar upon which the machinery of modern manufacturing and process industries relies. Today’s smart factories and highly automated production lines require cables that can withstand demanding conditions while offering lightning-fast data speeds, high reliability, and stringent safety. Whether it’s a robotic assembly line in the automotive sector or a food processing plant equipped with smart sensors, robust cables are the unsung heroes enabling seamless communication and efficient power transfer.

Digitalization and Industry 4.0 have redefined what’s possible on the shop floor. As machines, control systems, and humans grow more intertwined, the choice of cables directly impacts everything from operational uptime and equipment longevity to industrial safety and the capacity for predictive maintenance. Market studies and analyst reports underscore the sector’s vital role, but only by delving into its components—such as segmentation, market drivers, challenges, and innovations—can we fully grasp where it’s headed and why now is such an exciting time for stakeholders across the value chain.

Market Segmentation

Segmentation in the industrial automation cable market is crucial. It allows companies, investors, and end users to identify unique requirements and target solutions with precision. The main dimensions of segmentation include cable type, application, and geographical region.

Cable Type

According to Automation.com, cables serving industrial automation are typically categorized as:

- Power Cables: These handle the transmission of electrical energy, feeding machines, robots, and control panels. Designed for durability, they are often insulated to protect against voltage fluctuations, abrasion, heat, and chemical exposure.

- Control Cables: Designed to transmit signals, they orchestrate actions throughout automated systems. Their flexibility, noise shielding, and reliability are essential for programmable logic controllers (PLCs), sensors, switches, and actuators, ensuring timely data flow and system responsiveness.

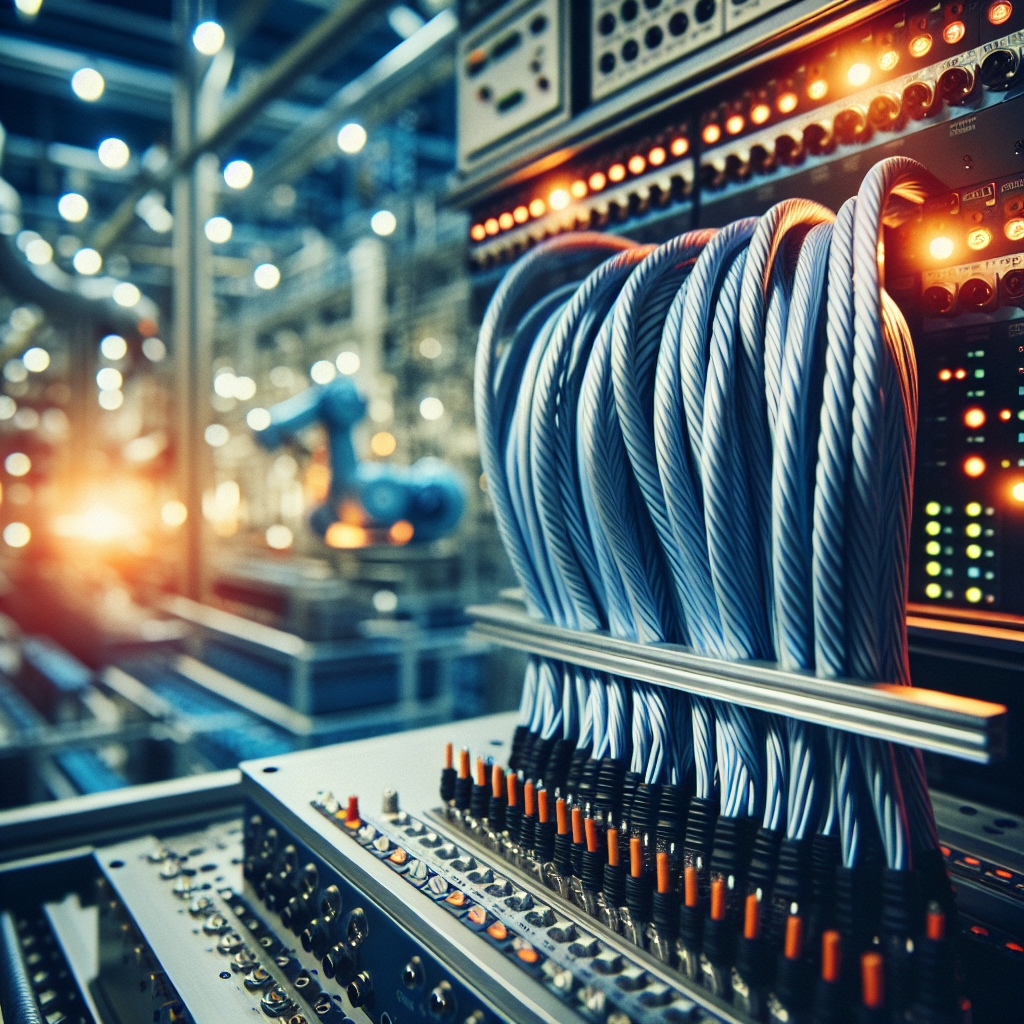

- Communication Cables: As factories become smarter, the need for fast, accurate data transmission explodes. These cables—ranging from classic RS-232/RS-485 serial cables to modern Ethernet and fiber optic lines—form the nervous system of Industry 4.0.

Application

The diversity of industrial environments demands specialized cabling:

- Robotics: Flexible, torsion-resistant cables for moving robotic arms.

- Automated Assembly: Cables with electromagnetic interference (EMI) shielding for use in noisy, high-speed production lines.

- Process Automation: Cables with chemical and temperature resistance for use in demanding industries like oil & gas, pharmaceuticals, and food processing.

- Infrastructure/Building Automation: Wiring for controlling heating, ventilation, air conditioning, elevators, and security systems within smart buildings and factories.

Geography

The global market is further divided into:

- Asia-Pacific (APAC): Rapid urbanization and industrial investments, especially in China, India, and Southeast Asia, fuel growth.

- Europe: Emphasis on Industry 4.0 and energy-efficient manufacturing promotes high-performance and eco-friendly cables.

- North America: Advanced industrial base, early adoption of IoT-based manufacturing, and substantial investments in retrofitting plants with modern cabling.

- Middle East & Africa / Latin America: Growth opportunities tied to infrastructure development, resource industries, and automation efforts in key industrializing economies.

Market Dynamics

The industrial automation cable industry does not exist in a vacuum. Several dynamic forces continually shape its size, its momentum, and its evolution.

Technological Advancements

According to Reuters, ongoing innovations drive much of the sector’s progress. The trend toward lighter, safer, and more durable insulation materials, coupled with enhanced resistance to harsh environments (moisture, oil, etc.), reflects both end-user demand and regulatory expectations. The shift from conventional copper wires to hybrid fiber optic solutions is particularly notable, allowing manufacturers to meet ever-growing data transmission needs with minimal signal loss.

Regulatory Changes and Safety

Regulatory regimes set by global and national authorities demand compliance with rigorous safety, insulation, and fire-retardancy standards. Changing electrical codes and occupational safety regulations, especially in Europe and North America, compel manufacturers to innovate product lines and invest in R&D, not only for compliance but to ensure market access.

Sustainability and Environment

The push for sustainable Industrial Internet of Things (IIoT) deployments brings eco-friendly materials and processes to the forefront. Lead-free, halogen-free, recyclable, or biodegradable sheathing materials win favor in procurement decisions, especially among public-sector buyers and multinationals with green supply chain mandates. Many manufacturers now offer “green” cable lines, seeking not only to please regulators but also to attract a younger, environmentally conscious workforce and investor pool.

Economic Cycles and Supply Chain Realities

Macroeconomic factors—like economic slowdowns, fluctuating raw materials prices, and global supply chain disruptions (as seen during the COVID-19 pandemic)—impact cable affordability, lead times, and strategic sourcing. In response, some companies invest in nearshoring production or creating buffer inventories, while others accelerate design for manufacturability or embrace digital twins and advanced simulation for rapid prototyping.

Emerging Applications and Technology Trends

The industrial automation cable market’s boundaries continually expand as new sectors join the march toward automation and as technologies reshape what’s possible on factory floors:

- Industry 4.0 and Smart Factories: The rise of self-optimizing factories with real-time monitoring, predictive maintenance, and cyber-physical systems amplifies demand for high-bandwidth, interference-resistant cables.

- Edge Computing and IIoT: As intelligence moves to the edge—where sensors, microcontrollers, and actuators operate—cables must deliver both data integrity and reliable power, even for energy harvesting devices or wireless infrastructure backbones.

- Flexible and Hybrid Cables: Factories featuring collaborative robots (cobots), autonomous vehicles, and modular machines require cables that combine power, data, and control inside a single, highly flexible sheath. This reduces installation complexity, increases uptime, and streamlines maintenance.

- Optical Fiber Cable Adoption: Particularly in cleanrooms, semiconductor production, or locations requiring long-haul connectivity without electromagnetic interference, fiber optic cables are supplanting traditional metal conductors.

- Condition Monitoring and Predictive Maintenance: Smart cables equipped with embedded sensors or RFID can report on their own health, facilitating maintenance before failure, lowering downtime, and supporting advanced analytics.

Regional Insights

The industrial automation cable market exhibits unique dynamics depending on regional context:

- Asia-Pacific: Surging electronics and automotive production, along with government-led smart manufacturing initiatives, have made China, Japan, South Korea, and India key markets. Rising labor costs and the need for precision in manufacturing encourage more robotics and, consequently, higher-quality cables.

- Europe: Demand is propelled by energy efficiency programs, strong regulatory enforcement, and widespread adoption of digital twins in manufacturing. The EU’s circular economy initiatives further compel manufacturers to seek recyclable and safe cable solutions.

- North America: The U.S. and Canada lead in early adoption of emerging trends such as edge automation and remote plant monitoring. Many facilities seek to update legacy systems and integrate them with new digital infrastructure, often requiring upgrades to cable infrastructure.

- Rest of World: Latin America, Middle East, and Africa show strong potential in sectors like mining, oil & gas, energy, and construction—especially where workers need protection from harsh climates, explosive atmospheres, or remote locations.

Competitive Landscape

This vibrant, constantly evolving industry features a blend of large global players and region-specific specialists. According to Wired, competition is most intense among leaders such as Prysmian Group, Nexans, Belden, LAPP, Southwire, Leoni, and others. Core competitive tactics include:

- Strategic Partnerships & Mergers: Firms join forces to innovate, expand distribution, and pool R&D resources. This gives them access to global supply chains and local know-how, especially in emerging markets.

- Specialization: Some manufacturers carve out niches in high-temperature cables, marine/underwater solutions, or ultra-flexible robotics wiring. Customization and engineering support are their hallmarks.

- R&D Investment: The most competitive companies invest heavily in miniaturization, advanced polymer development, and digital integration to stay ahead of shifting regulations and customer expectations.

- Customer Service & Technical Support: In a market where downtime is costly, companies differentiate themselves by offering rapid response, engineering assistance, and predictive maintenance services.

For new entrants or expanding firms, understanding the strengths, weaknesses, and innovation pipelines of incumbents is critical. Conducting a shoreside analysis—comparing warranty policies, on-time delivery rates, or post-sale service—can uncover strategic opportunities.

Challenges and Opportunities

Despite its growth, this market isn’t without hurdles:

- Complex Standards: Navigating the maze of IEC, UL, CSA, RoHS, and REACH certifications can slow time-to-market and inflate costs.

- Counterfeit Products: The proliferation of low-cost, substandard cables jeopardizes both safety and reputation for legitimate providers.

- Raw Material Volatility: Prices for copper, plastics, and specialty compounds can swing sharply, squeezing margins and complicating forecasts.

- Skill Shortages: The most advanced manufacturing processes—and the smart cables that serve them—demand highly skilled technicians for design, installation, and troubleshooting.

Opportunities abound for supply chain digitization, the integration of AI and machine learning in cable health monitoring, and service-based business models (cable-as-a-service, managed connectivity, etc.). Companies that invest in upskilling, forward-integrating into on-site support, or developing green innovations are particularly well positioned for the coming decade.

Future Outlook

The future of the industrial automation cable market will be defined by rapid evolution. As the number of connected devices in factories grows exponentially—forecast to reach tens of billions—so too will the demand for cables that combine power, high-speed data, robustness, and intelligence.

Expect heightened demand for self-monitoring cables, innovations in miniaturization, and new classes of materials that minimize weight, maximize recyclability, and all but eliminate signal noise and data loss. Growing integration with software ecosystems (including digital twins, SCADA, and MES platforms) will give birth to a new era of smart infrastructure on the factory floor.

At the geopolitical level, supply chain resilience and nearshoring will remain top priorities, driving investment in regional manufacturing hubs and dual-sourcing strategies. Finally, sustainability will evolve from a market differentiator to a baseline requirement for all industry participants.

Summary

The industrial automation cable market is experiencing sweeping change, shaped by segmentation nuances, technological breakthroughs, regional variations, and shifting competitive strategies. Businesses that stay attuned to these trends, invest in innovation, and adapt to both regulatory and sustainability pressures are best positioned for sustained growth and resilience.

FAQs

- What are the main types of industrial automation cables?

Industrial automation cables are mainly grouped into power cables (for energy transmission), control cables (for signal and control transmission), and communication cables (for fast, reliable data transfer). - How does market segmentation benefit businesses?

Segmentation helps manufacturers and suppliers better understand customer requirements, enabling more targeted product development, efficient marketing, and ultimately higher satisfaction rates. - What technology trends are driving the industrial automation cable market?

Major trends include adoption of fiber optics, hybrid cabling, self-monitoring and smart cables, eco-friendly materials, and systems designed for IIoT and Industry 4.0 factories. - Who are the leading players in this market?

Market leaders include global firms such as Prysmian Group, Nexans, Belden, LAPP, Southwire, and Leoni. They pursue M&A, regional expansions, and R&D to remain competitive. - What role does sustainability play in the market?

Sustainability is increasingly vital, with manufacturers investing in recyclable materials, eco-friendly production, and transparent supply chains in response to regulatory and customer demands.